SAICA & ACAUS (CAW USA) member Ryan Wheeler shared his experience of going through the US CPA reciprocity process in 2020 on the webcast linked below. He discussed study tips and tricks, study material used, as well as the before and after process to register with NASBA, to be eligible to write the required IQEX exam. Ryan also chatted about the current status of his CPA license application with the New York State Education Department (NYSED), along with requirements of some other States. Ryan formally obtained his US CPA license from the NYSED the week before Thanksgiving 2020.

Ryan is Director – Fund Administration and Reporting at Franklin Templeton. Until January 2021 he was an Audit Director for PwC, in the New York market, and he previously worked at PwC in Durban, South Africa. Ryan was hosted by Natasha Holbeck (SAICA Americas Sub-Region Representative) and Ryan Clacher (Director of Member Advocacy – East for CAW Network USA)

Webcast Link: CAW Network USA – SAICA MRA Update – Becoming a US CPA

Helpful Links from the Webcast:

- SAICA – MRA Details (Pg 13 and 14) – https://www.saica.co.za/portals/0/documents/Conversion%20requirements%20for%20CA%202020.pdf

- NASBA – IQEX Candidate Bulletin Board (October 2020) – https://nasba.org/app/uploads/2020/10/IQEX-Bulletin-2020_October16.pdf

- New York State Public Accountancy – Foreign Endorsement Requirements – http://www.op.nysed.gov/prof/cpa/cpaforeignpermit.htm

Frequently Asked Questions

Question 1:

What is the best practice material to use to prepare for the IQEX?

Answer 1:

That depends on what type of learner you are. Some of the CPA study courses have more lecture material and others have more practice question material. Some of the courses are more verbal-learning based whilst some are more visual-learning based. It really depends on your style and preference. Of course, some courses are ranked higher than others based on reviews done by certain individuals in the profession, etc., and there are also many sites that cover this topic, like this one. Also, remember that the IQEX content and exam structure is exactly identical to the Uniform CPA Regulation section, so you generally won’t see an IQEX course program advertised, as you just need to do the Regulation section of the usual CPA course program. We cannot endorse one program over another, but we can point out two things. i) CAW Network USA owns the “USCPA-NOW Comprehensive IQEX Program” and offers significant discounts for CAW Network USA members. This program is focused on individuals that already have CA (SA)’s under their belt and are 100% focused just on the IQEX exam, and ii) Many of our members who have written and passed the IQEX have utilized the Becker CPA Review course and have spoken very highly of it.

Question 2:

What is the cost of the practice material?

Answer 2:

Again, it depends on the CPA review course you choose. It’s important to remember that you only need to study the Regulation content, so avoid paying for the other 3 content sections of the Uniform CPA Exam. Generally, you are looking at costs anywhere between $1,000 to $2,000. Keep in mind that there are additional costs involved in applying to write the IQEX via NASBA as well as CPA license registration with a State Accounting Licensing Board – refer to the earlier links for more details on these.

Question 3:

How often are the exams?

Answer 3:

The exams used to be taken only once a quarter, so you would have 4 attempts a year. However, during 2020 the AICPA and NABSA agreed to a “rolling” testing window, which means that you are able to write as soon as you obtain your Notice to Schedule from NASBA and find an appropriate opening slot at a Prometric testing venue. If you end up not passing the IQEX, you can request another Notice to Schedule as soon as you find out your result and rewrite the exam in merely a few weeks depending on availability of slots at a Prometric testing venue. It’s much more convenient and allows test-takers to not risk losing the content absorption during the previous quarter lags.

Question 4:

Has anyone passed the exam yet?

Answer 4:

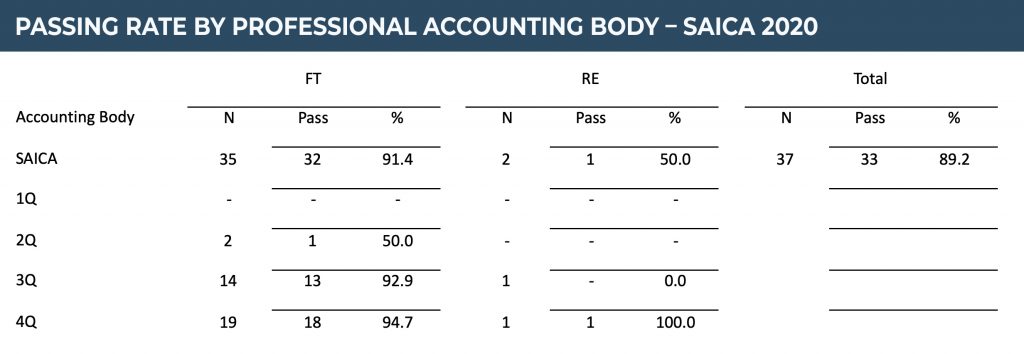

Yes. We are aware of a handful of members who have passed the IQEX under the SAICA MRA. They have indicated that although the exam was challenging, that the passed smoothly thanks to applying sufficient study time and using an appropriate CPA Review course. The 2020 SAICA results for SAICA members is noted below. Note that overall 166 IQEX exams were sat in 2020 with 128 passes overall (77.1%).

Question 5:

Which is the best state to write the exam?

Answer 5:

The process of applying for your Notice to Schedule with NASBA, and then writing the IQEX at a Prometric Testing Centre is all independent of any state preference. As an example, you could be living in New York, write the exam at a Prometric Testing Center in New Jersey, and then apply for your CPA license from the Connecticut State Public Accounting Licensing Board. The states only become relevant when it comes to applying for your CPA license, and we cover this topic in more depth in the webcast, and in other FAQs below.

Question 6:

What is the timeline for completion?

Answer 6:

The first members who went through this entire process (like Ryan in the webcast) had to deal with significant delays in early 2020 due to NASBA’s systems not being fully ready for the SAICA MRA, and with other delays caused by COVID-19. However, here is a rough timeline estimate that has been provided by members who have gone through the process, assuming no such unique delays described above:

- i) NASBA IQEX NTS application – 2 weeks

- ii) Scheduling your exam via Prometric – 1 day

iii) Study Time – 4 to 8 weeks (depending on how quickly you can get through the material)

- iv) Writing the IQEX – 1 day

- v) Obtaining your IQEX results – 2 to 4 weeks (depends on the date that you write)

- vi) Applying to state accounting board for CPA license – 4 to 12 weeks (dependent on state)

Question 7:

We received numerous queries around the state licensing requirements and which state is best to obtain your US CPA license.

Answer 7:

Each state has their own requirements for foreign license reciprocity, regardless of the agreement for the MRA between SAICA, NASBA and the AICPA. Certain states require you to have that state’s CPA license to practice as a CPA in that state (e.g. As an audit partner, or tax professional, etc.). However, for the majority of the CA(SA)’s living and working in the USA, it is likely that there is no specific state requirement, and that the individuals are just aiming to get a US CPA license (regardless of state). If that is the case, it’s important to research and understand the requirements for each state.

Currently, it appears that Arizona has a very updated list of requirements and that it may be one of the states with the ‘easier’ routes (i.e. not requiring any additional educational credit assessments, or experience requirements) via substantial equivalency. Florida, California and Georgia have 150 credit educational requirements for foreign reciprocity, and New York has a 4-year work experience requirement. Some other states that may have ‘easier’ routes include the following:

- Arkansas

- DC

- Idaho

- Indiana

- Iowa

- Kansas

- Kentucky

- Montana

- Ohio

- Tennessee

- Washington

Reminder to check the latest IQEX Bulletin (Nov 2020) for the latest states that recognize the IQEX and MRA (currently only a handful do not).

Update 1/21/2021 – We recently had a member who was struggling with the reciprocity in Georgia, so decided to apply in Arizona and Washington DC (District of Columbia). The Arizona one is still in process, but he was licensed in January 2021 in Washington DC as a CPA via the foreign reciprocity. The process is as follows:

- Apply online here

- Apply under foreign reciprocity

- Get a copy of the IQEX results sent directly to them ($25 from NASBA Store)

- Apparently, the IQEX score that is sent by the NASBA store also has the letter of good standing attached from SAICA (which was used to apply to write the IQEX) – but note that this letter is only valid for 3 months, so you may need to obtain a new one.

- Under license history put “no” for “you have not been registered in another state/jurisdiction” (they are referring to other States, not other countries)

- Upload an appropriate ID Document

- Pay the $175 license fee

- Additional Notes

- There was no residency requirement (i.e. to be living in Washington DC)

- There is no ethics test

- There was no need to provide proof of work experience

- There was no need to provide proof of semester hours/educational credits

- Process took 4 weeks from start to finish

- Final Tips – the system needs updating, and so you may need to reach out to the admin team (on the site) for help with paying by credit card and uploading of the IQEX score from NASBA, etc.

Question 8:

Some states require the 150-credit educational requirement (e.g. Florida, California, Georgia, etc.) even if you are applying for your CPA license via the MRA and have passed the IQEX. Is there a way to obtain these credits more easily & quickly then taking university classes?

Answer 8:

There are other methods to obtaining educational credits, but we advise specifically checking with your individual state as to what will exactly meet their requirements. Take a look at this site and option 1 (especially the DSST).

Question 9:

One of the big questions that came up was around maintaining CPA CPE and SAICA CPD – Will members have to maintain both?

Answer 9:

The short answer is yes, but it is much easier than members probably realize. With SAICA’s new CPD policy that came into effect at the start of 2020, which is an output-based measurement approach to Continuing Professional Development, the ability to be flexible and tailor the CPD plan to the CPA CPE requirements is as easy as it can ever be. The SAICA new CPD policy focuses on demonstrating the maintaining and development of relevant competence for you as a professional by generating an annual Continuing Professional Development reflective plan – and since obtaining required CPA CPE is part of your professional competency obligations, they will naturally easily overlap.

Question 10:

Can I become a CPA if I’m based in SA?

Answer 10:

Possibly, but very unlikely – as noted in the IQEX Candidate Bulletin Board:

“International administration of the IQEX is currently offered in England, Scotland, Ireland, Germany, Brazil, Japan, Bahrain, Egypt, Jordan, Kuwait, Lebanon, the United Arab Emirates and South Korea. If you live in one of these testing locations, or other select countries, you may be able to take the Examination without traveling to the U.S. The Examination is only offered in English, and is the same computerized test as the one administered in the U.S. You must pay additional fees for each examination section you plan to take in Guam or in international locations upon registration. Applicants from countries other than the U.S. must follow the same basic steps as U.S. applicants. For more information on the international administration of the IQEX, visit the International section of NASBA’s website.”

Update: With the arrival of covid AICPA / NASBA have also expanded testing, allowing the exam to be sat in India https://nasba.org/cpaexam-india/

Furthermore, most states have a residency or US-based work experience requirement that will also make it extremely difficult to obtain your CPA directly from South Africa. Note that you do not need to be a US Citizen.

Question 11:

Why should I do the CPA if I’m already a CA (SA)?

Answer 11:

The main reason is brand recognition within the USA. The CPA designation is much more well-known and recognized amongst the business community in the USA, regardless of business size, industry, state, etc. The CA (SA) designation is recognized by many multi-national & global businesses, but even then, many prefer to see a CPA designation as well. This is also because the CPA designation is an easy ‘check-the-box’ for businesses to know that the individual is familiar with USA regulations, business laws and tax laws. Many recruiters utilize filters on resumes and filtering out individuals without a CPA is a common issue for Chartered Accountants in the USA applying for finance, accounting and auditing roles. Also, many states require certain filings and/or audit opinions be signed off by a CPA registered in that state.

Question 12:

Moving from SA where IFRS is applied to the US where GAAP is applied – how did you find that change and do you have any tips and advice for me on how to quickly and best get up to speed with the concepts and principles of GAAP?

Answer 12:

It really depends on the industry you are working in, and the complexity of the accounting matters being dealt with. For example, in the asset management world, where everything is pretty much either cost (private) or fair value (public) or a mixture of both, all the base principle IFRS concepts all apply in that sphere as well to US GAAP. Specific accounting areas like Business Combinations and Share Based Payments will have specific rules and nuances that only apply to US GAAP. IFRS is principle-based while US GAAP is rule-based (though some areas are also principle-based when the AICPA was trying to assist for a couple of years with the global convergence of accounting standards) – and majority of the rules are straight-forward compared to learning to understand and apply the principles under IFRS. Many audit, accounting and consulting firms hold annual update training that highlight the major differences between US GAAP vs IFRS, which are very useful if you are working in areas where the differential is significant.

CAW Network USA has been partnering with BDO the last few years to offer IFRS updates to members, so do monitor upcoming events.

Question 13:

What does “in good standing” mean with regards to SAICA? How do I do that if I have not paid fees for a few years?

Answer 13:

The letter of good standing can be applied for directly from SAICA via their member portal, with a turnaround time of less than 48 hours. You cannot get a letter of good standing if you are in arrears with annual subscription fees – and you will have to pay all amounts due to be up to date with regards to fee balances.

The letter confirms the following information:

- Membership number and current membership of SAICA

- Successful completion of the SAICA accredited postgraduate graduate qualification, the SAICA Qualifying Examinations and met the SAICA Training Program requirements.

- Date of admittance into membership of SAICA and is the holder of a Certificate of Membership issued under the common seal of the Institute.

- That the member is in good standing.

- No outstanding complaints against the individual having been lodged with SAICA or any ethical or other matters that would cast doubt on their suitability for membership with another accounting professional institute.

- Individual members in Good Standing of this Institute (SAICA) are also obliged to undertake relevant Continuing Professional Development (CPD) activities on an annual basis, in terms of clause 2.1.1 of this Institute’s CPD policy. Based on the member’s own declaration we confirm they have met their Continuing Professional Development requirements as at this date.

- Members agree to abide by this Institute’s Constitution and By Laws at the time of admission to membership and thereafter on the annual subscription of the Institute each year at time of subscription payment.

- That the individual is up to date with all amounts owed to the Institute.

Question 14:

Can you re-join SAICA if you have not paid fees for a few years?

Answer 14:

Yes, you can. Your membership has lapsed. Per SAICA’s website, they advise that previous members in this situation should: “Please contact your Regional office, which will be able to advise you of the required information and payment.“ In this case, that would be contacting Natasha Holbeck and Ryan Clacher, as indicated earlier in this document. However, we also recommend just contacting SAICA at [email protected] – they are pretty good at responding.